The domestic wholesales of two-wheelers declined 13.19% calendar year-on-calendar year during the Coronavirus pandemic-strike FY21 even as the desire restoration in a few out of 4 quarters last fiscal unsuccessful to lift the yearly volumes, details out the information launched by the Culture of Indian Car Manufacturers (SIAM) on April 12.

In accordance to the industry information, the two-wheeler domestic volumes were being at 15,119,387 units during FY21 in opposition to seventeen,416,432 units a calendar year in the past, which indicates that the producers missing cumulative wholesales of much more than 2 million units despite clocking YoY progress during the September, December and March quarters last fiscal.

The two-wheeler domestic volumes grew .seventeen%, 13.37% and 24.29% YoY during the September, December and March quarters respectively during FY21.

Many industry analysts attribute the yearly volume reduction, in spite of the progress in H2 FY21, to the comprehensive nationwide lockdown imposed for about 2 months last calendar year, together with a series of regional lockdowns that stretched through H1 FY21.

The YoY drop in the two-wheeler wholesales, on the other hand, was sharper at 18% in FY20 on the back again of liquidity crunch, mounting car price ranges and an overall economic slowdown. Notably, the two-wheeler industry has noticed its domestic wholesale volumes slide from a peak of in excess of 21 million units, losing much more than six million units in excess of the last two money years by yourself.

Softening city desire

Scooters, which contributed much more than 1-3rd of the overall two-wheeler profits in India until 2 years in the past, recorded a share of less than 30% during FY21, in accordance to the SIAM information. Scooter profits stood at four.four million units during the last fiscal, dropping just about 20% YoY.

The a few premier scooter producers, Honda Motorbike & Scooter India (HMSI), TVS Motor Firm, and Suzuki Motorbike India have missing significant volumes last fiscal.

Even though HMSI, also India’s premier scooter producer, noticed its scooter profits dropping from 3.one million units in FY20 to 2.3 million units last fiscal, TVS Motor Firm, and Suzuki Motorbike India marketed 829,117 units, down from 927,979 units marketed in FY20, and 494,157 units, down 24% YoY, respectively.

“Since scooters are mostly an city phenomenon, declining share in the overall two-wheeler industry represents a dip in its desire in the city and semi-city marketplaces. This can be attributed to two variables – function from house observe that does not involve individuals to commute to function and next, unfavorable purchaser sentiments amid the middle-course customers who have been holding back again their investments amid the Coronavirus scare,” stated a senior govt at a leading scooter producing company, requesting anonymity.

Weighty exposure to scooters incurs industry share reduction for Honda

Owing to major exposure to the scooter phase, HMSI has even further missing its industry share in FY21. The company, which noticed scooters contributing about two-thirds of its whole profits in FY18, has missing its industry share from a peak of just about 29% in FY18 to 27% in FY20 and twenty five.fifty eight% in FY21.

Triggered by a sharp slide of 26% in scooter profits by yourself, Honda marketed a whole of 3.86 million units (which includes bikes) in FY21, down 18% YoY. On the other hand, the drop in the company’s bike profits was limited at one.26% YoY. It marketed a bit much more than one.five million bikes in India last fiscal.

Honda is now doing work to widen its space of aim to cater to the desire for mid-potential motorcycles, a product or service classification that not only presents reasonably greater margins per product or service marketed but also does not involve deep retail penetration throughout India.

Contacting the last fiscal a calendar year of unparalleled uncertainties, YS Guleria, director – profits and promoting HMSI, stated, “Honda resiliently overcame problems from the lockdowns to the unlocks although continuing to develop numerous new firsts. India became the epicentre of Honda’s 2 global unveilings – CB 350 and CB350 RS. This was followed with the debut of CB500X and CB 650R.”

It carries on to expand its premium bicycle shops, Honda BigWingstores as the exceptional footprint, now stands at in excess of fifty showrooms to assist profits and aftersales expert services.

In the meantime, using on portfolio growth and widening the achieve of its scooter lineup together with new product or service interventions, Hero MotoCorp has attained industry share by much more than a proportion point to 37% in FY21.

Whilst Hero MotoCorp marketed about five.fifty nine million units and witnessed a 10% YoY drop in FY21, the Pawan Munjal-led company has exclusively attained ground in the scooter phase by growing its industry share from 7% in FY20 to 10% last fiscal. The company’s scooter profits were being at 443,458 units, up 10% YoY for the last fiscal.

“FY21 has been a interval of sharp revival for us despite the backdrop of a significant downturn in the automotive industry. We currently are providing the broadest variety of scooters and motorcycles. Hero MotoCorp will be launching a host of new items in excess of the next five years,” stated Naveen Chauhan, head – profits and aftersales, Hero MotoCorp.

Mass-industry motorcycles carry on to encounter headwinds, premium bikes maintain

Mass industry or entry-stage bike phase carries on to encounter headwinds as the one hundred-110cc bicycle classification, the most significant in terms of volumes in the overall two-wheeler phase has however once more recorded a drop of in excess of 15% YoY in yearly volumes. In accordance to the SIAM information, 75cc-110cc bike profits were being at five.38 million units in FY21 in opposition to six.37 million unit profits in FY20 and eight.43 million units in FY19.

Even though Hero MotoCorp noticed a YoY drop of eleven% at four.one million units, Bajaj Auto, the 2nd premier producer in this sub-phase, recorded a sharp slide of 32% at 734,712 units in FY21, which marked the 2nd calendar year in a row for the two organizations to shed massive volumes.

“When the desire for entry-stage motorcycles falls, it signifies incredible deficiency of economic security in the industry. Small enterprises, as very well as the careers throughout the rural, semi-city and city marketplaces, have been strike in excess of the previous 2 years. Even though the concern of position losses carries on, lack of COVID-19 vaccines and the rapidly-spreading 2nd wave is incorporating even further uncertainty to the purchaser sentiments,” stated a senior industry govt quoted earlier mentioned.

On the other hand, the desire for 150cc-200cc premium commuter motorcycles has registered a surge of 27% YoY with wholesales in this product or service classification enhancing to 969,384 units last fiscal, SIAM information reveals.

Even though Honda and Hero have pushed progress in this sub-phase with new product or service launches, Honda’s profits jumped from sixty seven,410 units to 289,609 units last fiscal, many thanks to the start of the new 184cc Hornet model.

New product or service launches which includes the XPulse and Xtreme variants in this classification have enabled Hero MotoCorp to increase its profits from 30,a hundred seventy five units in FY20 to sixty five,618 units in FY21.

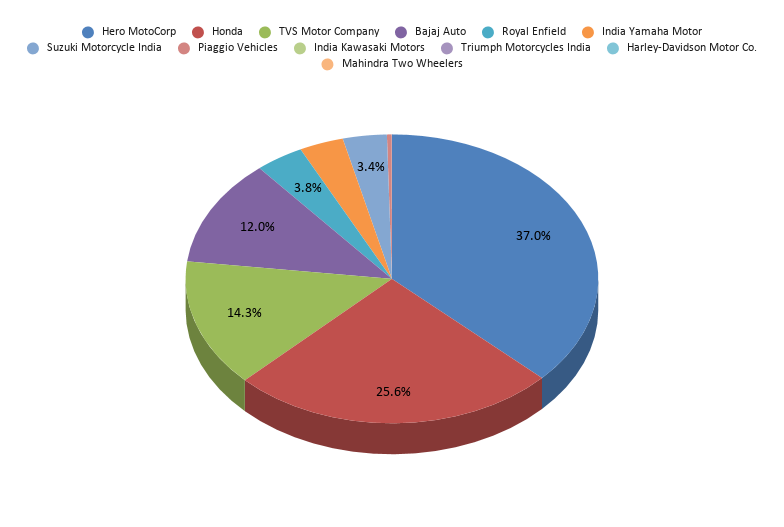

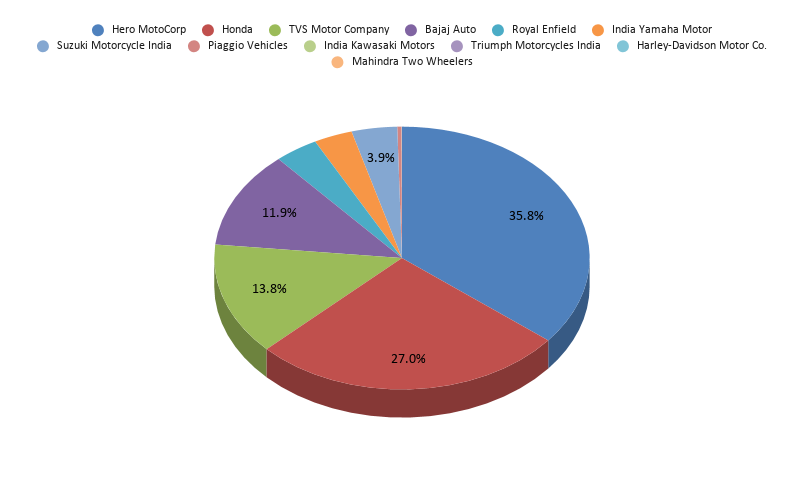

Annual Volumes and Current market Share

| Businesses | FY2020-21 | Current market share FY21 | FY2019-20 | Current market share FY20 | % improve YoY in yearly profits |

| HeroMotoCorp | five,599,859 | 37.04% | six,231,458 | 35.78% | -10.14% |

| Honda | twenty five.fifty eight% | four,706,589 | 27.02% | -seventeen.82% | |

| TVS Motor Firm | 2,164,228 | 14.31% | 2,410,550 | 13.84% | -10.22% |

| Bajaj Auto | one,809,375 | eleven.97% | 2,078,348 | eleven.ninety three% | -12.ninety four% |

| Royal Enfield | 573,438 | 3.seventy nine% | 656,651 | 3.seventy seven% | -12.sixty seven% |

| Indian Yamaha Motor | 524,186 | 3.forty seven% | 578,226 | 3.32% | -9.35% |

| Suzuki Motorbike India | 521,474 | 3.forty five% | 685,219 | 3.ninety three% | -23.ninety% |

| Piaggio Cars | fifty six,069 | .37% | sixty two,638 | .36% | -10.49% |

| India Kawasaki Motors | one,284 | .01% | 2,628 | .02% | -fifty one.14% |

| Triumph Bikes India | 725 | .00% | 591 | .00% | 22.sixty seven% |

| Harley-Davidson Motor Co. | 680 | .00% | 2,495 | .01% | -seventy two.75% |

| Mahindra Two Wheelers | 252 | .00% | one,039 | .01% | -75.75% |

| Overall | 15,119,387 | one hundred.00% | seventeen,416,432 | one hundred.00% | -13.19% |

More Stories

How the Lucid Air Pure EV came in at under $90K

4 Simple Hacks to Pick a Good Car Repair Shop in Houston

Jeep Avenger Review (2022) | Autocar