New Delhi: Numerous countries across the globe are reeling less than the strain of the Covid-19 pandemic and lockdowns. National economies and companies are counting prices and measuring the impact of the huge malady brought about by the virus. The automotive sector, which entails a very intertwined world offer chain to develop major-ticket goods on a mass scale, is globally less than tension.

In accordance to the most up-to-date report by LMC Automotive, ASEAN Mild Motor vehicles (LV) marketplace is projected to clock complete gross sales of two,890,000 mn models in 2021, as against its past estimate of two,940,000 models.

Curiously, in April 2021 ASEAN area which includes Indonesia, Thailand, Malaysia, Philippines, Singapore, Vietnam and Brunei witnessed a leap of 388% year‐on‐year (YoY) in its LV gross sales. Nevertheless, the huge development was flattered by the small foundation in April last yr, when the marketplace recorded gross sales of just fifty,387 models as every country in the area was less than some form of lockdown, which dampened financial activity and disrupted LV need.

| ASEAN Mild Motor vehicles | April 2021 | April 2020 | % Expansion |

| Revenue | 245,972 | fifty,387 | 388 |

| Creation | 1,208,721 | 49,320 | 2350 |

The report mentioned that all figures are based on Mild Motor vehicles (LV) with Gross Automobile Excess weight (GVW) considerably less than six tonnes.

On a year‐to‐date (YTD) basis, the ASEAN LV gross sales registered a 28% development at 913,721 models, as against 714,377 models in the similar time period last yr. Nevertheless, the gross sales were under the January‐April 2019 time period, when they stood at 1,080,000 models.

“We do foresee a gradual enhancement in LV need going forward, but all round gross sales are not predicted to recuperate to their pre‐pandemic concentrations right until 2023, due to the prolonged nature of the disaster across the area and the delay in reopening countries for mass tourism,” the report pointed out.

| ASEAN Mild Motor vehicles | Jan- April 2021 | Jan-April 2020 | % Expansion |

| Revenue | 913,721 | 714,377 | 28 |

| Creation | 1,208,721 | 985,814 | 23 |

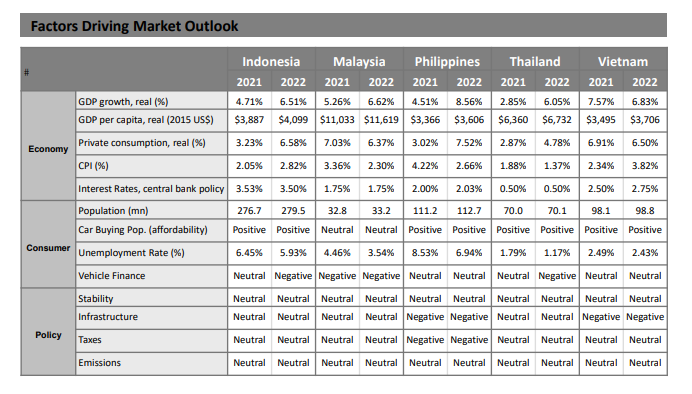

The report highlighted that the projections have been downgraded on account of the downwardly revised projections for Thailand, Malaysia and the Philippines. “On the moreover aspect, we have elevated the Indonesian LV outlook as gross sales are staying boosted by the short-term tax lower plan,” it added.

Country-sensible assessment

The automotive intelligence agency spelled out that the Malaysian authorities has imposed a complete nationwide lockdown, dubbed FMCO, from 1-28 June. Automobile dealerships are permitted to offer you right after-gross sales products and services, less than rigid authorities pointers, but all gross sales activity is prohibited. To aid the neighborhood automobile business, the authorities has prolonged the short-term tax lower plan from June to December 2021.

“The blend of these two aspects led us to downgrade the 2021 LV outlook to 560,000 models, with the hazards to the downside as the constraints could be prolonged even further. We have also lower the LV gross sales forecasts for Thailand and the Philippines and now job gross sales of 830,000 models and 303,000 models, respectively, in 2021,” it pointed out.

| Mild Automobile Revenue | January 2021 | February 2021 | March 2021 | April 2021 | Jan-April 2021 |

| Indonesia | 48,874 | forty four,915 | seventy nine,667 | seventy three,736 | 247,192 |

| Malaysia | 33,529 | 43,496 | 65,030 | 58,872 | two hundred,927 |

| Philippines | twenty five,a hundred seventy five | 28,one hundred | 22,440 | 19,016 | 94,731 |

| Thailand | 55,496 | fifty nine,113 | seventy four,430 | 58,430 | 247,469 |

| Vietnam | 32,381 | seventeen,289 | 37,814 | 35,918 | 123,402 |

| Whole | 195,455 | 192,913 | 279,381 | 245,972 | 913,721 |

The weaker potential clients for the Thai marketplace are due to the reinstatement of restricted constraints nationwide to suppress the latest resurgence of COVID‐19. Advance figures show weaker‐than‐expected gross sales of around fifty,000 models in May perhaps as the containment actions were prolonged into June. We have downgraded the forecast for the Philippines due to a number of explanations particularly April gross sales staying a little under anticipations, safeguard obligation is evidently undermining gross sales, it is feasible that the social constraints will be tightened yet again, and GDP shrank by a worse‐than‐expected four.two% YoY in Q1 2021, marking financial indicators are negative.

Nevertheless, LMC has elevated the Indonesian gross sales outlook to 755,000 models this yr as the marketplace remained buoyant in April, despite the prevalence of Ramadan, with need staying boosted by the short-term Luxury‐goods Revenue Tax (LST) lower.

On 14 June, on the other hand, the Indonesian authorities amended the short-term tax lower plan by extending the exemption time period for two-wheel-generate (2WD) and sedan automobiles with engines of 1,five hundred cc or considerably less, although leaving the criteria for 2WD and 4wd automobiles with engines of 1,501 cc to two,five hundred ccs unchanged. The amended plan could see LV need in Indonesia strike 800,000 models by the stop of 2021.

For Vietnam’s LV forecast in 2021, the report has built nominal alterations with gross sales established to access an all‐time high of 440,000 models, next a marginal contraction last yr.

More Stories

Remixed By Prazis Air Suspension

Volvo EX90 – Car Body Design

Ford Ranger Raptor and Wildtrak V6 wait times blow out to a year