New Delhi: Ashok Leyland Ltd, India’s next largest business auto maker, will develop its export basket of mild business motor vehicles (LCV) in the around time period on the energy of the new solution launches on its Phoenix platform, a senior enterprise government explained.

“The Phoenix platform, within just the assortment it operates, will throw up a lot more and a lot more variants within just the future quarters and for that reason we will be growing our presence within just this platform. On prime of that, we will naturally be seeking at taking part a lot more in the LCV phase small business general due to the fact of the great self-confidence we have in our products and solutions and the current market share gains we had,” Vipin Sondhi, handling director and chief government officer, Ashok Leyland, explained.

The Chennai-centered enterprise has redrawn its export tactic with a more substantial solution portfolio for its world-wide shoppers than 5 decades in the past. With its large assortment of products and solutions in both of those the remaining hand and the proper hand generate, the enterprise is focusing on West Asia and Africa to develop the footprint of its LCVs and the freshly-produced AVTR trucks. Released in March 2020, AVTR is a new modular truck assortment that arrives with i-Gen6 BS-IV engineering.

Our total export tactic is to obtain some of the addressable marketplaces initial with the LCVs and then penetrate it more with ICVs and M&HCVsGopal Mahadevan, Main Monetary Officer, Ashok leyland

“Our total export tactic is to obtain some of the addressable marketplaces initial with the LCVs and then penetrate it more with ICVs and M&HCVs. This is due to the fact the radius of service for LCVs is confined as they are mostly intra-town and are straightforward to start and preserve the profits and service network. When the brand name is set up, we can speedily scale up to the ICV small business and then shift on to M&HCV,” Main Monetary Officer (CFO) of Ashok Leyland Gopal Mahadevan explained on a get in touch with on Friday with analysts.

The LCV initiative is very important from the global small business standpoint and the enterprise will carry on to fill in the white places within just this phase with new products and solutions, he explained.

The new generate will assistance the enterprise consolidate its situation in the LCV phase, whilst continuing the focus on medium and major business motor vehicles (M&HCVs), Mahadevan explained.

LCVs have been extremely resilient to the double jolts of Covid-19, and contributed to above 50% of Ashok Leyland’s whole yearly auto profits in FY21 in contrast to 28% in FY19.

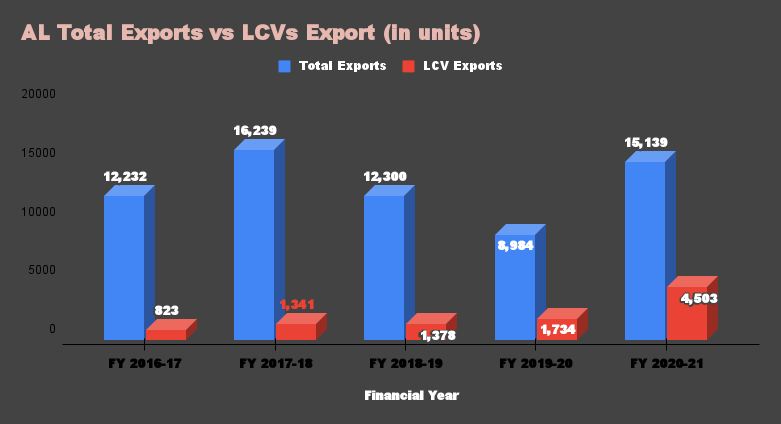

When Ashok Leyland’s general exports grew above one.five periods in FY21 to 15,139 models year-on-year, the firm’s LCV exports rose nearly three periods to 4,503 models.

The share of LCVs in the firm’s general exports increased 5-fold to 30% from 6% above the past 5 decades driven by new solution introduction in the sub-five tonne group such as Dost Moreover and Bada Dost.

A lot more launches on Phoenix platform

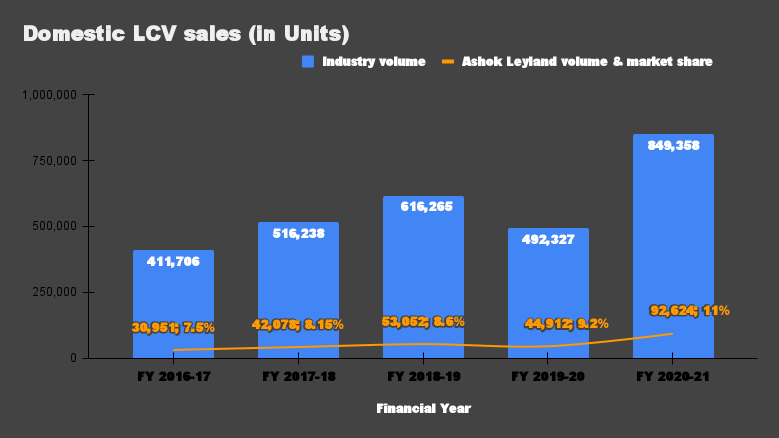

As the business auto market is crippled by the pandemic-induced lockdowns, Ashok Leyland is banking on its indigenously-produced LCV platform Phoenix to enhance its domestic current market share from the present 11%. The new platform will allow for the enterprise to cater to both of those the proper-hand and the remaining-hand generate marketplaces throughout the world.

In September 2020, the enterprise launched its initial LCV assortment on this platform referred to as Bada Dost in two variants – i4 and i3 in 3-3.five tonne gross auto fat (GVW) classes with a beginning price tag of INR7.seventy five lakh. With Bada Dost the enterprise, which at this time retains 11% current market share in the LCV group, is eyeing to double its addressable current market to 65% from the present 34% in the future three decades.

Even in these hard periods the LCV space is receiving sizeable desire traction from e-commerce and grocery transportation segments. Staying the only phase in the business auto space which is demonstrating expansion, the firm’s LCV phase will see various new launches from the Phoenix platform in the coming months.

The Society of Indian Automobile Companies (SIAM) data reveals that the CV maker has recorded steep expansion in the LCV phase in spite of the ongoing slump in the domestic current market. In FY21, it recorded 106% y-o-y expansion to ninety two,624 models, towards the single digit expansion to seventy six,528 models in the wholesale volumes of its M&HCVs because of to the delayed alternative cycle and slowdown in freight movement.

FY22 Capex

The Hinduja Team flagship enterprise has lined up a Capex system of about INR 750 crore for the existing fiscal which will mostly be invested on servicing and debottlenecking on the LCV side. According to the senior management, the enterprise is not seeking for any brownfield or greenfield growth this year.

With the gradual re-opening of the overall economy and cyclical upturn the CV phase is envisioned to see improved profits in the coming quarters. Professionals say that Ashok Leyland has employed the downcycle as an chance to remodel its portfolio to future-gen platforms with the start of a unique AVTR platform for trucks.

“The CV sector has been in a down cycle considering that FY18 and Ashok Leyland, with about 60%-70% revenue contribution from M&HCVs, is most likely to advantage from the upcoming desire up cycle. The government’s infrastructure drive along with solid desire from the mining sector is envisioned to generate HCV desire. The company’s AVTR platform would bring a top-quality charge composition with enhanced customer flexibility,” a the latest take note from ICICI Securities explained.

More Stories

Road Test: 2022 Chrysler Pacifica Limited Plug-in Hybrid

Event Coverage: ImportExpo Toronto 2022

2023 Nissan Versa starts at $16,825