New Delhi: The earlier two years have of course been complicated for considerably of the overall economy. The onset of the next wave of the pandemic and looming menace of Omicron has impacted the presently-having difficulties India’s journey to prosperity. With the slowdown that the overall economy experienced suffered, the country’s growth amount experienced decelerated from 8.3% in 2016-17 to 4% in 2019-20.

With this qualifications, when Finance Minister Nirmala Sitharaman stepped up on the podium to desk the Union Spending plan for 2022-23, it was the 2nd spending plan amid the dread of COVID-19. Even the Financial Study report introduced in Parliament a working day ahead of the finances noted the troubles from the new variants of COVID-19 and the uncertainties in the global economy.

And, that is why maybe the operate-up to the Spending plan has been a lot less noisy within just the automobile industry this 12 months than typical. Nevertheless, that does not necessarily mean the sector experienced no anticipations and demands from the finance minister.

It is no solution that the Indian vehicle market has confronted a significant slowdown simply because of COVID-19, global semiconductor scarcity and unbridled commodity value boosts.

Each the OEMs and the element suppliers had been hoping to get some direct fiscal and policy assist in this year’s spending plan to battle the odds for resilience and survival. Electrical car or truck segment was anticipated to be the concentrate region. Offering an impetus for investments was also a lot needed. Big bets have been also becoming placed upon taxation and infrastructure enhancement among the quite a few others that will support the business embark on a extensive-phrase expansion route.

Whilst the Finance Minister’s finances speech on February 1, 2021 outlined several new provisions and increased investments to get the car field back on monitor, some substantial alternatives were being also skipped. Moreover, the auto market did not come across any immediate point out in Union Budget 2022, which dismayed most of the stakeholders.

In this reading record, we choose a closer search at some major takeaways of the Budget, which experienced a good variety of hits and misses.

The hits:

Improved allocation of capex, superior focus on for nationwide highways, the proposal of an EV battery coverage, tax incentives for startups, help for MSMEs, Emphasis on rural overall economy, and raise to nearby components production, and are some of the key hits of the Union Finances 2022 from the automotive marketplace standpoint.

Increased allocation of capex

An boost in capex expenditure, and target on infrastructure throughout the board, is a significant constructive. The govt has introduced a sharp soar of 35.4% in capex outlay to INR 7.5 lakh crore subsequent year as in opposition to INR 5.54 lakh crore in the latest year. This go will provide the significantly-needed impetus for the business car sector, especially the M&HCV phase, which has witnessed sharp demand contraction above the past two many years.

Significant concentrate on for countrywide highways

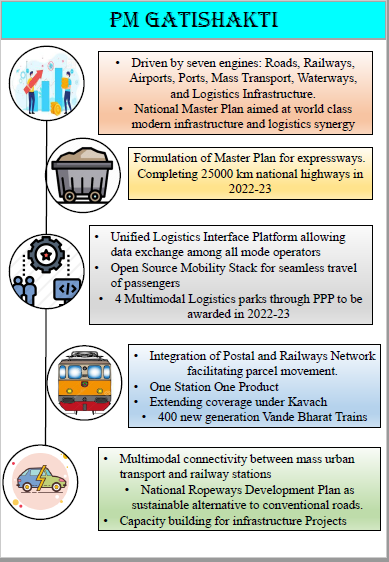

Enlargement of nationwide highways by 25,000 km underneath the Government’s Gati Shakti Programme, that encompasses thrust on 7 distinct engines of growth, which includes streets, railways, and multi-modal logistics infrastructure, augurs effectively for the demand for commercial cars, particularly Tipper Trucks, building sector and tyre sector.

Gurus opine that allocation of INR 20,000 crore for street infrastructure assignments is probably to guide to a spillover demand for hefty obligation vans and development tools and also enhance use of tyres.

Coming before long, EV battery coverage

1 of the landmark announcements of this Budget is the battery swapping coverage, which has the likely to be a recreation-changer in catalysing the migration to EVs. Even further, the government’s transfer to develop specific mobility zones for EV alongside with encouraging the non-public sector’s involvement to generate sustainable and impressive business types for battery and strength as a assistance will strengthen the total EV ecosystem of the state.

According to the professionals, industrial EV brands, notably in electric powered two and a few-wheelers, will earnings from this announcement and it is very likely to insert assurance to the prospective passenger EV consumers also. The proposed battery-swapping plan will assistance create expectations of interoperability thus making EVs far more obtainable and reasonably priced.

Apart from, vehicle part producers will also get a fillip as the proposal will persuade clean investments for indigenous battery makers.

Tax Incentives for startups

In new years, the number of mobility startups has elevated rapid and extra guidance has turn into offered in all dimensions. In a bid to give a raise to the country’s “growth motorists,” the finance minister on Tuesday announced an extension of the interval of incorporation of qualified startups by 1 much more year for furnishing tax incentives.

In her Budget speech, the Finance Minister also proposed capping surcharge on very long-term money gains arising on transfer of any style of belongings at 15%.

“This action will give a raise to the startup community and alongside with my proposal on extending tax positive aspects to production organizations and startups reaffirms our dedication to Atma Nirbhar Bharat,” Nirmala Sitharaman reported.

She also recommended the placing up of an qualified committee to keep track of mobilization of money for startups by means of undertaking capitalists and non-public equities.

Assistance for MSMEs

The MSME sector in the manufacturing house receives a improve with rolling out of the government’s Boosting and Accelerating MSME Effectiveness (RAMP) programme with an outlay of INR 6,000 crore in excess of 5 years. The objective of this programme is to increase credit score and current market entry of MSMEs. The Finance Minister also mentioned that the Credit score Promise Rely on for Micro and Tiny Enterprises (CGTMSE) scheme will be revamped with a essential infusion of cash and will aid additional credit history of INR 2 lakh crore for MSMEs and extend employment.

MSMEs sort around 80% of local car sections and RAMP programmes will aid tackle a lot of of their burning concerns like delays in payment and access to credit rating.

Emphasis on rural overall economy

The announcement on MSP payment of INR 2.37 lakh crore to farmers would persuade rural demand, which has remained sluggish right after the next wave of COVID-19. “The notion is to improve rural revenue and enable rural use by placing money right in the arms of the farmers,” Rajat Wahi, Husband or wife, Deloitte India, stated.

According to score agency ICRA, the Government’s continued concentration on rural progress and farmer welfare in the price range will uplift rural sentiments, and therefore remains good for the tractor and two-wheeler phase.

Raise to area sections production

The Price range proposed growing import obligation on particular components (these as braking programs, digital and motor elements like lights, windscreen wipers, turbo chargers) to 15% from 7.5% -10% before. This will definitely motivate area producing of these factors, which has been yet another concentrate region of the governing administration. Nevertheless, on the flip aspect there are some disadvantages as nicely.

“In the interim it could increase the selling price of cars further, which has been on an upward trend amid expanding enter price tag, and so hurt the total demand,” Shruti Saboo, Associate Director, India Rankings and Analysis, mentioned.

The significant misses:

No rationalization of GST on vehicles, and no aid in private profits tax are some of the big misses in the Finances 2022. A key shock is the prepare to impose an extra differential excise responsibility of INR 2 a litre on unblended petrol and diesel.

No rationalization of GST on cars

The federal government but once more side-lined the prolonged-standing need of the automotive marketplace for reducing GST charges. All the auto and related goods are now taxed at the stages of luxury objects and fall in the bracket of best 28% slab. On prime of that, cess is levied from 1% to 22% if the car or truck exceeds a sure human body or engine dimensions.

Bigger GST costs are making cars unaffordable for prospective buyers specially when amplified selling prices of uncooked components, successive fuel price hike, harder security and emission rules have by now amplified the enter value.

Together with this is the government program to impose an added differential excise obligation of INR 2 a litre on unblended petrol and diesel, car gasoline will undoubtedly develop into far more high-priced in times to come. For that reason, gross sales of the ailing commuter two-wheeler section will have a tendency to get a further large jolt in coming months.

Petrol price spiked in pretty much all the months of 2021, at times even in each week of a thirty day period that shot up the possession price tag of 100-125 cc bikes and 110 cc scooters any where in between 14% and 15% last calendar year. Notably, this entry segment constitutes 75% of the two-wheeler income in the domestic market.

No reduction in individual earnings tax

Individual taxpayers and salaried center course are hugely let down as the finance minister did not make any main announcement to present any aid to this section. From the vehicle industry point of watch, they are almost certainly the key consumers in the regional market, therefore neglecting them in the pandemic-induced current market will additional hold off the revival prospects.

In conclusion, the price range is not likely to promptly induce a usage revival within the auto sector though it is curated to crank out liquidity for shoppers in the prolonged term in both of those rural and city regions. As for each Vikas Bajaj, president of the Association of Indian Forging Marketplace (AIFI), “Apart from encouraging EVs (electric autos) by building a battery-swapping method to conquer EV charging infrastructure, I believe that there is not a lot in the funds to assist the vehicle sector as was predicted.”

Also Check out:

More Stories

Jeep Avenger Review (2022) | Autocar

Flat Rat: A Slammed1950 Ford COE Firetruck On Air

Bullitt Reboot — Steven Spielberg Planning Sequel to 1968 Classic