For the very first time in the Tata Group’s history, the chairman of Tata Sons and CEOs of all working firms will consider an estimated 20% reduce in compensation as the conglomerate initiates price tag-reducing steps. The go is aimed at primary by instance, motivating staff members and organisations and making certain small business viability, insiders reported.

TCS, the group’s flagship and its most successful firm, was the very first to announce a reduce for CEO Rajesh Gopinathan. Indian Hotels has by now reported its senior leadership will “contribute a share of their salary this quarter to support with the survival period of the company”.

CEOs and MDs of Tata Metal, Tata Motors, Tata Power, Trent, Tata Global, Tata Cash and Voltas, between many others, will have their compensation lessened, executives reported. Top officers near to the advancement reported the reduce would principally be in current yr bonuses.

“These are occasions by no means just before skilled in the history of our group and it calls for some tricky steps to safeguard firms,” reported a best group CEO searching for anonymity. “We will do all that it takes to make sure suitable leadership with empathy. As a lifestyle, the group has constantly ensured staff members down the line are shielded as considerably as can be.”

Tata Sons chairman N Chandrasekaran had informed ET earlier that each individual firm will evaluation its HR plan, profits arranging and income move management.

Steps in Check out of Covid Pandemic

“We will be compassionate and each individual firm will consider a selection independently to make sure a viable small business,” Chandrasekaran had informed ET.

Tata Sons and most group firms did not reply to ET’s e-mail on the subject matter. A Tata Metal spokesperson reported, “Remuneration is a selection which rests with the remuneration committee of the board of Tata Metal. It thus may perhaps not be suitable to pre-empt a way forward in the matter.”

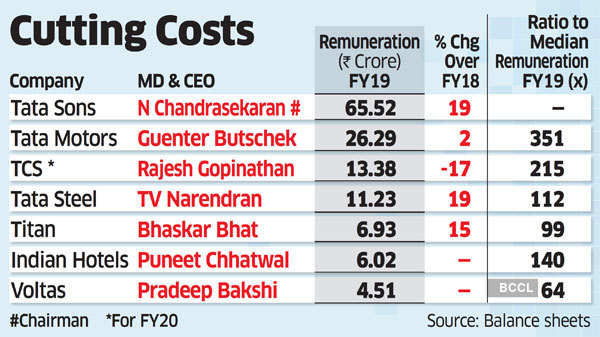

CEO remuneration at the best 15 Tata Group firms rose about 11% in FY19 from FY18 on regular as opposed with a fourteen% soar in FY18 more than FY17. Barring TCS, no other device has revealed the FY20 yearly report so considerably. On the other hand, the information is not strictly similar as some CEOs joined during the monetary yr.

Chandrasekaran acquired a total remuneration of Rs sixty five.52 crore for FY19, which involves a Rs fifty four crore commission on the financial gain of Tata Sons. His package was 19% better than in FY18.

On the small business front, Tata Group revenue of 33 listed firms rose 10% to Rs7.52 lakh crore in FY19. Three firms — Tata Motors, Tata Metal and TCS — contributed virtually eighty two% of total revenue. On the other hand, revenue of the 33 firms declined 20% in FY19 from FY18. TCS contributed virtually Rs32,340 crore to Tata Group financial gain, followed by Tata Metal at Rs10,218 crore in FY19.

TCS chief government Rajesh Gopinathan’s remuneration dropped sixteen.five% to Rs13.3 crore in the fiscal yr finished March 31from Rs sixteen.04 crore in the preceding monetary yr.

“The government remuneration for FY20 is decreased than FY19 in perspective of the financial problems impacted by the Covid-19 pandemic,” reported the TCS yearly report. He gained 215 occasions the median remuneration. Tata Motors CEO Guenter Butschek was paid Rs26.29 crore, the most between group CEOs and 351 occasions the median remuneration.

The firm manufactured a decline of Rs28,828 crore in FY19. Tata Metal, which documented a sixteen% compounded revenue advancement more than three a long time and 88% financial gain advancement during the period, lifted CEO Tv set Narendran’s salary by 19% to Rs11.23 crore in FY19. Titan and Tata Elxsi, the two ideal firms as considerably as advancement was anxious, lifted CEO remuneration by 15% each individual in FY19. The CEO pay back package at Trent, Tata Substances, Rallis India and Tata Espresso rose about 10% in FY19.

More Stories

Audi A6 Avant e-tron Proves Electric SUVs Are Overrated

Chip Ganassi and PNC Bank launch Women in Motorsports campaign

BMW iX3 M Sport Reviews | Overview