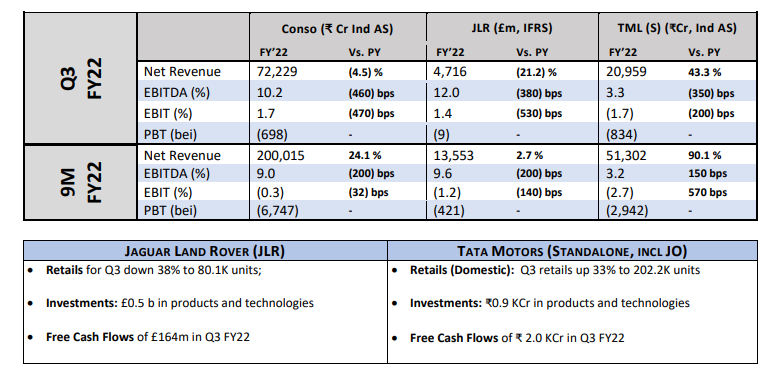

The auto major’s consolidated earnings from operations stood at INR 72,229 crore, when compared to INR 75,653 crore all through the exact time period final 12 months.

Its complete fees stood at INR 73,639 crore in Q3 FY22, as against INR 71,775 crore in Q3 FY21. The firm claimed consolidated EBITDA at 10.2%.

On a standalone foundation, the car significant posted a reduction of INR 175.85 crore as against INR 638.04 crore in the same quarter very last 12 months. Its income from functions stood at INR 12,352.78 crore, when compared to INR 9,635.78 crore a year back.

The India functions of the organization showed earnings improvement when compared to Q3 a calendar year back. Nevertheless, commodity inflation. “PV enterprise ongoing its turnaround journey and strengthened its double-digit sector share with optimum gross sales in any calendar yr due to the fact inception. EV profits witnessed a new peak of 5,592 units in Q3 FY22,” the business mentioned.

Girish Wagh, govt director, Tata Motors, stated, “The vehicle business continued to witness soaring need in most segments even as the provide of semiconductors remained restricted resulting in adverse effects on creation. We keep on to raise marketplace share in every single phase of business autos and established various new milestones in passenger autos with 10 years higher product sales for the two the quarter as properly as the calendar year 2021. We also recorded the optimum ever EV sales all through the quarter and sold 10,000 EVs in 9MFY22, crossing new milestones.”

“At the time of publishing effects, we have operationalized two subsidiaries, Tata Motors Passenger Autos Ltd. concentrating on passenger autos run by IC engines, and Tata Passenger Electric Mobility Confined to accelerate the enhancement of the passenger EV business and its enabling ecosystem. On the lookout forward, we assume the demand for commercial, passenger and electric powered automobiles to sustain even as considerations associated to supply of semiconductors, higher input fees and climbing occasions of covid hold the all round predicament fluid. We will keep on being agile, address supply bottlenecks proactively, push our price savings application more difficult, acquire prudent pricing actions though continuing to make great development in our foreseeable future-in shape initiatives of transforming customer encounter digitally and strengthening our lead in sustainable mobility,” he mentioned.

JLR product sales stay constrained

Sales of the firm’s United kingdom-based subsidiary, Jaguar Land Rover (JLR), remains constrained by chip shortages with retail profits of 80,126 automobiles in the course of Q3 FY22, down 37.6% about Q3 FY21, the organization claimed.

“The chip supply predicament is gradually increasing with output volumes of 72,184 units up 41% around Q2 FY22 and wholesales of 69,182 units up 8% on Q2 FY22. For Q3, profits was £4.7 billion, up 22% from Q2 FY22. EBIT margin was 1.4% and free funds flow was constructive at £164 million in Q3 FY 22, demonstrating the progress JLR created in lessening the breakeven issue in the business as a result of blend optimisation and expense efficiencies,” it said.

Thierry Bolloré, chief government officer, JLR, said, “Whilst semiconductor materials have ongoing to constrain profits this quarter, we keep on to see quite powerful demand for our items underlining the desirability of our automobiles. The world wide buy ebook is at history stages and has grown to 30,000 models for the New Selection Rover even in advance of deliveries start this quarter.”

“We continue on to execute our Reimagine tactic to realise the complete potential of the business and generate the future technology of the most fascinating luxury vehicles for the most discerning of customers,” he said.

Going ahead, Tata Motors stated the demand remains strong regardless of close to-time period problems from Omicron spread. The semiconductor supply condition is enhancing little by little whilst inflation worries persist. Around the past two several years, the resilience of the organization has improved, and it is now intrinsically stronger. With concerted actions in place to handle the in the vicinity of-term provide and charge problems, we hope general performance to increase even further in Q4 FY22 and beyond.

Also Browse:

More Stories

Remixed By Prazis Air Suspension

Volvo EX90 – Car Body Design

Ford Ranger Raptor and Wildtrak V6 wait times blow out to a year