By Rajeev Singh, Sumit Mishra and Saket Mehta

India is anticipated to develop into the 3rd most significant by 2026. In spite of a scrapping plan, the scrapping of autos is not still commensurate with the expansion in generation of the new ones. It is predominantly due to the fact of the unorganised and modest-scale mother nature of the scrapping sector. This has led to an boost in the range of out of date autos, also known as close-of-existence autos (ELVs), which possibly rot on roadways, or are disposed of in an unscientific fashion, jeopardizing general public wellbeing and setting. According to a Central Pollution Control Board (CPCB) analyze, the range of out of date autos is anticipated to grow from 8.seven million in 2015 to 22 million by 2025 developing additional worries for the region.

The ‘voluntary vehicle – fleet modernisation programme or the ‘vehicle scrappage policy’ is anticipated to assist cut down pollution, produce demand for new autos, and make a new business place of scrapping and reclaimed metals and other materials.

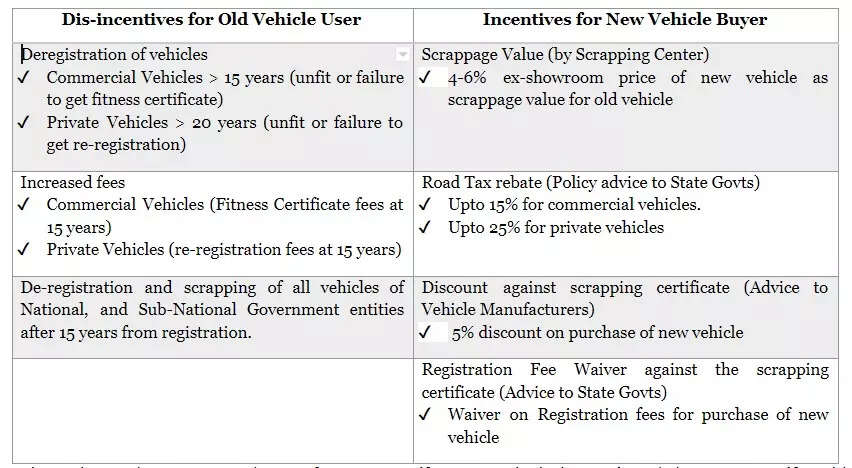

The plan is obtaining a great combine of incentives (for new vehicle buyers) and disincentives (for outdated vehicle proprietors), and so it is possible to market vehicle scrappage and make demand for new autos.

The numerous incentives and disincentives proposed under the Car Scrapping Coverage, 2021 are introduced under:

New vehicle demand

International practical experience implies that plan can act as a device to promote car demand. The plan becoming balanced is anticipated to make a optimistic impact on buyers to go in advance with scrapping of their outdated autos and buying of new ones, and after the advantages are realised, it is anticipated to make a multiplier impact foremost to the sought after effect on the sale of new autos in the region.

As per the CPCB estimates, the range of out of date 4-wheelers in the region by 2025 will be:

· Passenger autos (LMV): 2.8 million

· Industrial autos (MCV & HCV): one.28 million

The estimated range of out of date autos is superior and so is the potential. But the results of the plan will hinge on professional advantages from scrappage vis-à-vis the present techniques of resale, and its stringent enforcement.

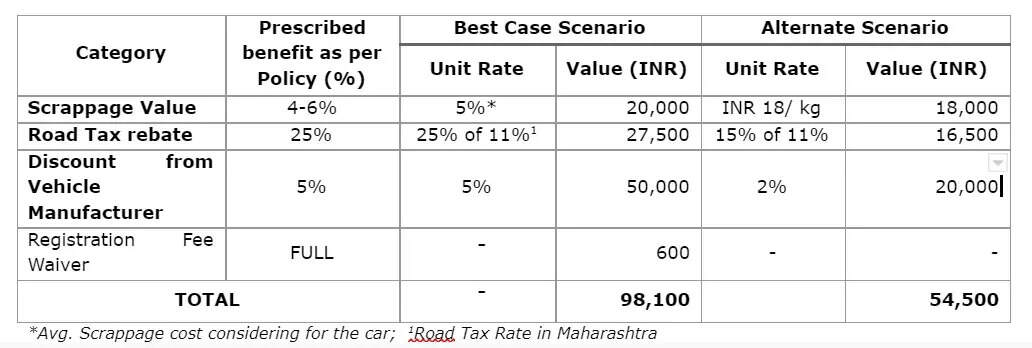

An example of the professional advantages for a new passenger vehicle customer who also avails scrappage advantages for outdated autos is labored out under.

New mid-sector car or truck (petrol): INR 10,00,000 (ex-showroom Mumbai)

Outdated car or truck mass-sector (petrol): INR 4,00,000 (ex-showroom Mumbai) | Excess weight Assumed: 1000 kg

Based mostly on the example it can be seen that the actual advantage to the customer can be in the selection of INR 54,500 (assuming a particular situation) to a utmost of INR 98,one hundred depending on the actual incentives prolonged by the state authorities and the vehicle maker. The advantage selection becoming large could be a make or crack for execution of the vehicle scrappage plan. Although the plan advantages are great, a whole lot relies upon on the state authorities and OEMs.

Recycled steel

Recycled steel is applied in the producing of vehicles, and a typical passenger vehicle works by using about 25% recycled steel out of its complete requirement. As a result, there is great demand for recycled steel in car producing. On the other hand, the availability of scrap for secondary steel producing is a key challenge in India, and the region is dependent on import of scrap which prospects to an boost in the value of generation.

A vehicle scrapping sector utilizing best-in-class systems for scrapping out of date autos is possible to boost the availability of recycled uncooked materials manifold. For instance, around sixty five% of a vehicle contains metals, with a large element of the remaining factors becoming made of plastic, rubber, glass, etc. As a result, a whole lot of steel scrap can be made available for reuse if the procedure of scrapping is scientific, foremost to decreased input charges for vehicle companies.

The OEMs obtaining their presence in steel producing (specifically secondary steel producing) will be in a position to leverage this to the utmost. Other OEMs can tie-up with their steel suppliers and operate out an arrangement to source steel scrap and just take the advantage. But the actual advantage that can be realised by an car maker will depend on the performance of the logistics community for aggregation and scrappage becoming developed.

New business place

The plan will assist in formalising and scaling up a new business place of ‘Scrappage Yard’ or ‘Registered Car Scrappage Facility’ (RVSF) which has been unorganised and mainly comprised modest-scale gamers.

To offer with the out of date autos systematically and scientifically, by 2025 the region could have to have about sixty five-one hundred RVSFs. If the backlog and long run expansion are taken into account, the have to have for such services will be additional. As a result, the business potential is massive.

The OEMs can leverage their present dealership community to build shopper loyalty programmes (acquire-again strategies) and give greater benefit for the new vehicle to such buyers who approach to scrap the exact same manufacturer vehicle with them.

A Deloitte analyze has found that the conventional design of passenger vehicle ownership is anticipated to adjust to a subscription-based design in the coming decades. In its study seventy two% of the respondents were inclined to opt for ‘subscription to a brand’ design where they can choose a number of autos for subscription from the exact same manufacturer.

As a result, new business versions with forward and backward integration in the benefit chain are anticipated to emerge in the automotive sector developing opportunities for the OEMs to innovate.

(Disclaimer: Rajeev Singh is Lover and Automotive Chief, Deloitte India. Sumit Mishra, is Director, Deloitte India, and Saket Mehta, is Affiliate Director, Deloitte India. Views expressed are their very own.)

More Stories

Road Test: 2022 Chrysler Pacifica Limited Plug-in Hybrid

Event Coverage: ImportExpo Toronto 2022

2023 Nissan Versa starts at $16,825