MUMBAI: Leading officers at the Office of Weighty Industry lately achieved stakeholders of the automotive field to go over their localisation initiatives, amid the government’s force on Atmanirbhar Bharat (self-reliant India).

Reps of the Culture of Indian Vehicle Makers, Automotive Part Makers Affiliation (ACMA) of India, condition-operate BHEL and HMT, testing agencies and automakers together with Volkswagen, Tata Motors and TVS Motor attended the assembly chaired by Office of Weighty Industry secretary Arun Goel, individuals in the know stated.

This initially assembly with the automotive field stakeholders was element of a lengthy-expression road map aimed at growing localisation of production. There was a simply call to collaborate, check potential and consider stock of mutual competencies, offered the view that organisations were being performing independently and not pooling means.

“It is essential for Motown bodies to occur collectively to assistance just about every other at this time,” one particular of the attendees explained to ET.

“The federal government will not want import dependence but import substitution. Localisation is a will have to as it provides predictability, specially with trade-amount fluctuation,” Toyota Kirloskar senior vice president (revenue & provider) Naveen Soni stated. He stated seven essential suppliers of the automaker experienced set up their services around its factory outdoors Bengaluru, which experienced served lower logistic charges.

There is a view that means of PSUs this kind of as BHEL and HMT, together with their genuine estate and pool of engineers, could be utilised. The division is making an attempt to map the means to see how they can work collectively, stated the individuals.

“We need certain localisation endeavours for electronic factors as we simply cannot rely only on imports. And, there is an prospect listed here to localise by pushing for reskilling of these sectors,” Frost & Sullivan vice president (mobility practice) Kaushik Madhavan stated. Collaboration is a will have to to make the ecosystem, he stated.

While two-wheeler suppliers have a snug amount of localisation, some of the auto suppliers are struggling to apply their programs to localise, specially offered the price to set up services and time restrictions.

“To entice firms to create locally, we need to be competitive and lower charges compared to other countries,” ACMA director-general Vinnie Mehta stated. “Having stated that, localisation and new solution improvement simply cannot materialize overnight. It takes two-three many years to create new goods and take a look at and validate them thereafter.”

Suppliers are getting this step to safeguard against any international sourcing fluctuations affecting the availability of essential parts.

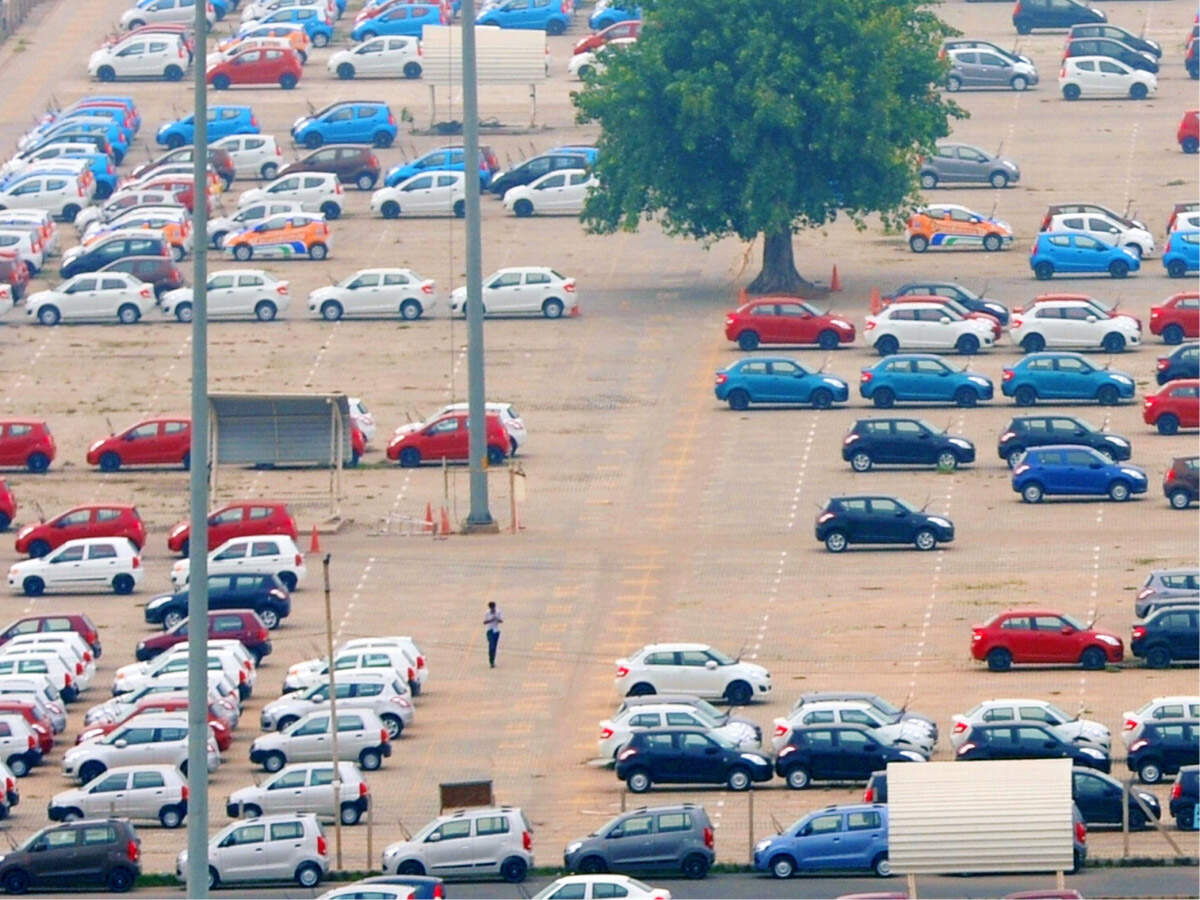

While ancillaries are bullish about the localisation initiatives, a segment of car majors who were being earlier against this thought are also now embracing the regional manufacturing route. Organizations like Mahindra & Mahindra, Maruti Suzuki and Toyota are supporting part makers in the endeavour to reduced import dependence. Mahindra has diminished dependence on imports at the tier-1 amount to very low one digits.

The $57 billion Indian car part field has began methods in the direction of deep localisation to de-risk small business from Chinese imports. The recent border standoff in between India and China will possible hasten this approach. India imported automotive factors well worth $four.75 billion from China in fiscal 2019, up seven% from the previous yr, according to ACMA figures. Organizations have maintained that for specific parts, if the selling price variance is extra than 5-seven%, import does not make it that price competitive.

Also Examine: ETAuto Originals: Will China fade away on the Indian vehicle turf?

More Stories

How the Lucid Air Pure EV came in at under $90K

4 Simple Hacks to Pick a Good Car Repair Shop in Houston

Jeep Avenger Review (2022) | Autocar